All Categories

Featured

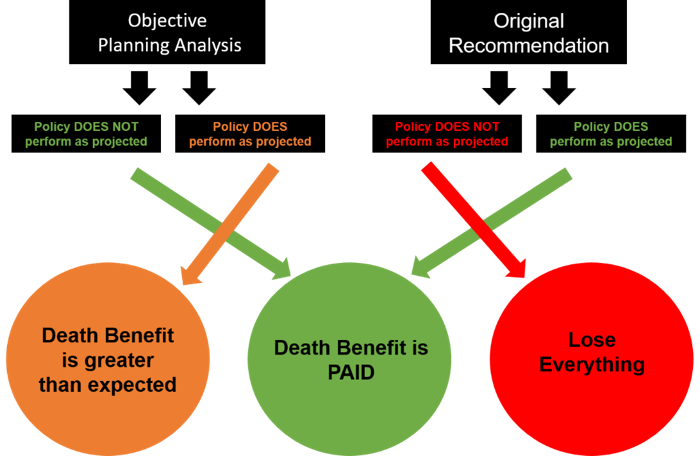

There is no one-size-fits-all when it revives insurance. Obtaining your life insurance policy plan ideal thinks about a number of factors. [video description: Pleasant music plays as Mark Zagurski speaks to the camera.] In your active life, economic freedom can seem like an impossible goal. And retirement may not be leading of mind, since it seems so far away.

Fewer employers are supplying standard pension strategies and many business have minimized or terminated their retired life plans and your capacity to depend exclusively on social protection is in concern. Also if advantages have not been reduced by the time you retire, social safety and security alone was never ever meant to be adequate to pay for the way of life you desire and are worthy of.

/ wp-end-tag > As component of a sound economic technique, an indexed universal life insurance coverage policy can help

you take on whatever the future brings. Prior to committing to indexed universal life insurance policy, here are some pros and cons to think about. If you pick an excellent indexed global life insurance strategy, you may see your money value expand in worth.

Fixed Universal Life

Since indexed universal life insurance policy needs a specific level of danger, insurance coverage companies have a tendency to keep 6. This type of plan also supplies.

Typically, the insurance company has a vested passion in carrying out better than the index11. These are all factors to be considered when picking the ideal type of life insurance for you.

Is Iul Insurance A Good Investment

However, because this kind of plan is more intricate and has an investment component, it can commonly include greater premiums than various other plans like entire life or term life insurance. If you do not assume indexed universal life insurance coverage is right for you, here are some choices to consider: Term life insurance policy is a momentary policy that usually supplies protection for 10 to thirty years.

When determining whether indexed global life insurance policy is ideal for you, it is very important to consider all your options. Whole life insurance might be a far better selection if you are searching for more security and consistency. On the various other hand, term life insurance might be a better fit if you just need coverage for a particular time period. Indexed universal life insurance is a type of policy that uses much more control and flexibility, along with higher cash money worth growth capacity. While we do not provide indexed global life insurance policy, we can offer you with more details concerning whole and term life insurance policy plans. We suggest checking out all your options and talking with an Aflac representative to discover the very best fit for you and your family.

The remainder is contributed to the cash worth of the policy after charges are deducted. The cash worth is credited on a month-to-month or yearly basis with passion based upon increases in an equity index. While IUL insurance coverage may verify useful to some, it is necessary to recognize just how it functions prior to acquiring a plan.

Latest Posts

Wrl Ffiul

Indexed Universal Life Insurance Vs Whole Life Insurance

Whole Life Vs Indexed Universal Life